The latest edition of the Romanians New Media Adoption report, conducted by Spark Foundry’s Data Intelligence team, a media agency part of Publicis Groupe Romania, reveals a notable shift in media consumption habits among urban internet users. While online activities are declining, trust in traditional TV news has increased, signaling a renewed reliance on traditional media:

- internet vs. TV: 45% of users prefer watching news on TV, with increasing trust in this medium compared to online sources. Meanwhile, 41% search online for products seen in TV commercials;

- decline in digital engagement: most online activities have seen a downturn, with the sharpest drops in online gambling, news consumption, and payments. However, online payments remain the most popular activity, followed by information searches, online shopping, and social media usage;

- media preferences: younger audiences (18-24) favor online video platforms (YouTube), social media, and podcasts, while those aged 35+ remain loyal to traditional TV and radio. Printed press is gaining traction among the 25-34 age group;

- streaming platforms evolution: Netflix leads in popularity, followed by HBO Max and Disney+, with Smart TVs being the preferred device for accessing these platforms;

- social media & e-commerce: 80% of users find the product tags on social media useful, driving a growing trend of purchasing directly through Instagram pages.

“In the context of a busy period in terms of events, both in the sports and electoral fields, there is a noticeable increase of trust in TV news, to the detriment of those distributed online. This trend reflects a return to traditional sources, which are often perceived as more credible or thoroughly verified. We also observe a decrease in simultaneous online activities among those watching TV programs, suggesting a more focused and attentive consumption of information delivered on the small screens.

However, recent experiences remind us that the influence of social media remains considerable and cannot be ignored. Even though television seems to have regained ground, online platforms continue to play an essential role in shaping public opinion due to the speed and dynamism with which they distribute information. Thus, it is essential to be aware that both traditional and digital media significantly impact how we perceive and understand the surrounding reality.” Stated Mădălina Bâdea, Head of Data Insights, Spark Foundry.

This study offers a comprehensive overview of the preferences and behaviors shaping media consumption in Romania, providing valuable insights into trends across various demographics. It is part of Focus On: New Media Usage, a series of reports that track the evolution of media consumption behaviors based on quantitative studies. This report was conducted in October 2024, being the second of the two annual reports in the series.

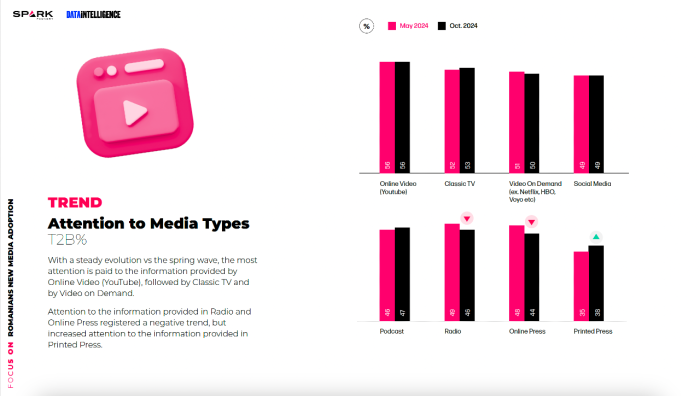

Attention to different media types

Urban internet users favor online video platforms like YouTube, followed by traditional TV and video-on-demand services. Interest in radio and online press has declined, while printed press has gained attention.

Classic TV appeals to those aged 35 and older, while radio attracts people aged 35-55, and online press engages users aged 45+. Younger audiences, especially those aged 18-24, prefer online video, video-on-demand, social media, and podcasts. Those aged 25-34 are more interested in printed press. Podcasts are popular among ages 35-44, while those aged 45-55 favor YouTube, video-on-demand, and printed press. These trends show a generational shift from traditional to digital media.

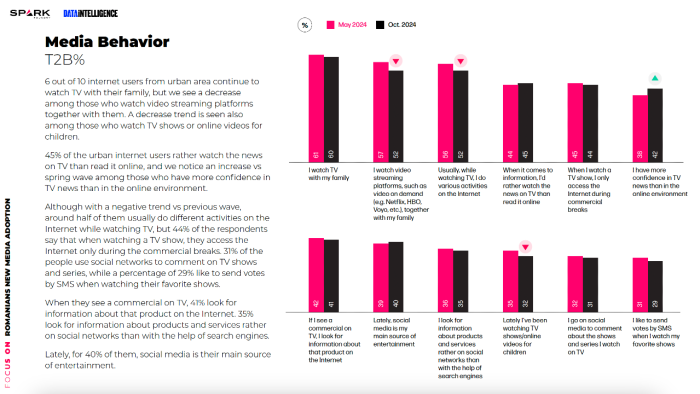

Media Behavior – TV vs. Internet

Six out of ten urban internet users still watch TV with their family, though fewer are watching video streaming platforms together. There’s also a decline in the number of people watching TV shows or online videos for children. When it comes to news consumption, only 45% of urban internet users prefer watching the news on TV rather than reading it online, though more people trust TV news over online sources compared to the spring wave.

Around half of urban internet users multitask on the Internet while watching TV, with 44% accessing the Internet only during commercial breaks. Thirty-one percent use social networks to comment on TV shows and series, while 29% enjoy voting by SMS during their favorite programs. When they see a TV commercial, 41% search online for information about the product, and 35% prefer using social media rather than search engines to find details about products and services. Social media has become the primary source of entertainment for 40% of users.

Age also plays a role in media habits. People aged 35-55 are more likely to watch TV or streaming platforms with their family and prefer TV news. Those aged 18-44 use social media for entertainment and tend to look for product information on social networks instead of search engines. Younger viewers, especially those aged 18-24, typically access the Internet only during commercial breaks to comment on social media about the shows they watch. Like those aged 45-55, they also frequently search online for product information from TV commercials.

Searching for information on the internet

There is a decline in all types of online information searches, especially text-based searches, with decreases in image searches and direct searches on TikTok and Instagram. People aged 45 and over mainly use text-based searches, while those aged 25-44 prefer image and voice searches. Users aged 45-55 often search directly on YouTube. Younger users, particularly 18-24, gather information from Instagram, while those aged 25-34 turn to TikTok. Searches on retailer websites are more common among those aged 18-24 and 35-44.

Ways to explore new music

Around half of urban internet users discover new music through official YouTube artist channels, while 40% find it via TV or radio. About 30% come across new tracks through background music in videos on social media, and 23% use music streaming apps. YouTube channels for music are particularly popular among users aged 18-24 and 35-55, while background music on social media appeals more to those aged 18-24 and 35-44. Younger users, especially those aged 18-24, prefer discovering music through streaming apps, while those aged 45-55 still rely on radio, and users over 55 mostly find new music on TV.

Evolution of digital activities

This wave shows a decline in most online activities, with the biggest drop seen in online gambling, followed by decreases in reading online news and making online payments. Despite the overall decline, online payments remain the leading digital activity, followed by searching for non-news information, online shopping, and social media engagement.

Main reasons for using social media

Social media platforms remain the primary way for people to stay connected with friends and relax during their free time, although the use of social media for relaxation and filling spare time has significantly declined, reaching its lowest point yet. There have also been notable decreases in using social media to follow favorite brands or support social causes.

People aged 45 and over, as well as those aged 18-24, primarily use social media to stay connected with friends, while those over 55 also turn to social media for relaxation or supporting social causes. People aged 45 and over use it to stay updated on news about family, friends, or colleagues. Younger users, especially those aged 18-24, engage with social media for its diverse content, including posting pictures and videos, making new friends, joining communities, discovering trends, and following their favorite brands. Those aged 25-34 are more likely to follow celebrities and influencers, while users aged 35-44 use social media to search for products they intend to buy.

Social media platforms

Aside from slight decreases on Facebook, Instagram, and Pinterest, there were no significant changes compared to the previous wave, with TikTok maintaining consistent usage levels. Facebook remains the most used platform, especially among people aged 45 and over. Users aged 18-34 are more drawn to Instagram and TikTok, while those aged 35-44 prefer Pinterest and Clubhouse. X (Twitter) is popular among users aged 18-44, while Tinder and Reddit are mainly used by younger users, particularly those aged 18-24.

Romanians Favorite Type of Content on Social Media

Images, videos, and articles remain the most popular content on social media, though all have seen a decline. Images and text are favored by users aged 18-24 and over 55, while videos and articles are preferred by those aged 45 and older. Instagram stories are most popular with users aged 18-24, gifs with those aged 25-34, and audio content with users aged 35-44.

Activities on Instagram

Following friends’ posts on Instagram has declined, with following stories and reacting to pictures or videos now sharing second place. Tracking celebrities and joining online communities have seen the greatest growth. Users aged 18-24 engage most with stories, celebrities, contests, communities, polls, and filters, while users aged 25-44 prefer posting stories. Users aged 35 and older are more likely to react to pictures and videos and engage with ads. Those over 45 prefer following posts or sharing videos, with live shows, swiping up, and IGTV more common among users aged 35-44. Users aged 45-55 tend to post photos more frequently.

TikTok and influencer campaigns

The growth in awareness of influencer campaigns stopped in October 2024, returning to the level seen in May 2023. The most distinctive and memorable campaigns were associated with music, tourism, beauty and fashion, as well as gastronomy. However, aside from music-related campaigns, all other categories experienced a decline compared to the previous wave.

Metaverse

Metaverse awareness has declined, with about half of urban internet users familiar with the concept. 63% are interested in exploring virtual experiences, with 48% interested in educational activities, 46% in virtual concerts, and 43% in socializing. Interest in most virtual experiences has dropped, except for sports betting, real estate, and casino-related activities.

Artificial intelligence

There has been no significant change from the previous wave, with 31% of urban internet users reporting use of artificial intelligence. Of these, 63% use AI for chat, 39% for image generation, 30% for document analysis, and 27% for video creation.

Audio content platform and podcast

Awareness of social media platforms offering audio content has significantly increased. Users value them for privacy and access to engaging, useful information. Weekly podcast listening has risen to 53%, with interviews, lifestyle/health, and entertainment/celebrity content remaining the most popular, despite a slight decline in interest in some topics.

The evolution of live streaming platforms and content

Music remains the most popular type of live streaming, followed by entertainment and concerts, although there have been notable declines in the live streaming of concerts, tourism, and lifestyle content. YouTube continues to lead as the most used platform for live streaming, despite a significant drop compared to previous waves, narrowing the gap with Facebook, which saw growth. Instagram and TikTok follow closely, with a notable number of users also following events directly on the organizer’s page.

E-commerce through social media

80% of urban internet users still find the tag function on social media useful, as it provides direct access to online store pages. Additionally, 78% value the product tag feature for allowing them to see prices before visiting the store. The most notable increase was seen among users following brand or influencer pages that use product tags, as well as those purchasing products directly from Instagram without visiting an online store. More users are also making purchases after clicking on tagged products in social media posts.

Romanians and gaming activities

There has been a decline in activities such as playing/downloading free video games and games on smartphones, while activities like playing games on social networks, using subscription services (e.g., XBOX LIVE, PlayStation Plus, Steam), and streaming live gaming content have seen growth. Users aged 18-24 and 45+ tend to engage in free or mobile games, while those aged 18-34 prefer streaming live content. Subscription services are most popular among individuals aged 18-44, while social network gaming is favored by users aged 18-24 and 35-55.

Younger users (18-24) often play games with friends, while those aged 35-44 are more likely to play with strangers. Users aged 25-34 are the primary group purchasing video games online. Despite an overall decline, 40% of urban internet users still search for games, with a shift towards prioritizing game graphics and design over customization. Recommendations from friends and game design are key for users aged 18-34, while 18-44-year-olds focus on storylines or gaming influencer recommendations. Popularity is a major factor for those aged 18-24, and customization is more important for those aged 25-44. Free games are sought after by users aged 18-24 and those over 55.

Online communities

Although the negative trend persisted, urban internet users still primarily join online communities to connect with people who share similar interests. However, a positive shift was observed among those who engage more actively within these communities, creating connections and friendships. Additionally, there was an increase in users who feel they have gained more benefits since joining a brand’s community.

Local targeting and Proximity Events

The use of app functions to search for nearby events has decreased, although local targeting usage remained stable. There was a slight increase in the likelihood of attending events based on brand social media posts, but fewer people are seeking additional event information. Events on social networks still attract the most interest from those aged 45-55, while individuals aged 18-44, especially 18-24-year-olds, are most likely to attend these events.

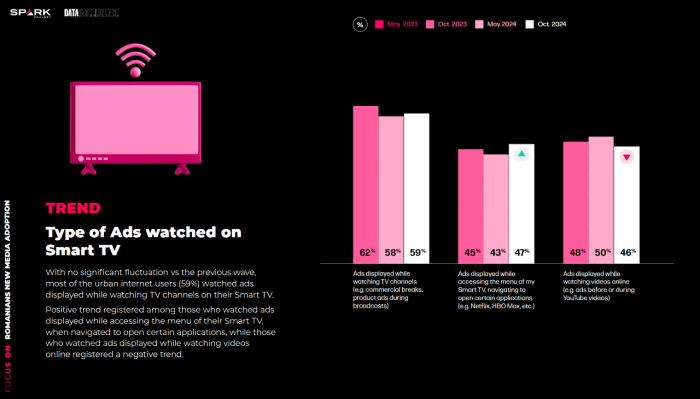

Romanians and smart TVs

Among urban internet users, 87% have at least one Smart TV, with 31% exclusively watching online content like YouTube or Netflix, reflecting a slight increase. Consequently, the number of people watching both traditional TV and online content has dropped to 51%. The majority (59%) still watch ads during TV channel viewing on Smart TVs, with a positive trend in ads shown while navigating the Smart TV menu, though ads during online streaming saw a decline.

Ads during TV viewing were most common among those aged 18-24 and 45+, while users aged 18-34 mostly saw ads while navigating the menu. There was an increase in those exclusively watching subscription-based content like Netflix, with younger users and those over 55 tending to access both paid and free content. Users aged 45-55 are more likely to stick to subscription-based services.

Video on Demand

49% of urban internet users have a video streaming subscription, with 77% accessing content via Smart TVs. There has been an increase in smartphone usage for streaming. Netflix remains the most popular platform, seeing slight growth, while HBO Max declined. Disney+ grew, surpassing previous levels, while SkyShowTime and Voyo saw significant decreases.

Methodology

The study was conducted by the Data Intelligence team of the media agency Spark Foundry, using the CAWI (Computer Assisted Web Interviews) method, on a sample of 801 male and female internet users aged 18 and older, living in urban areas, during the period of October 23-28, 2024.

All Publicis Groupe Romania proprietary data tools in one place.

All Publicis Groupe Romania proprietary data tools in one place.Discover the power of our tools and feel free to get in touch.