Together with our partners from GWI, a Global consumer research platform, we are releasing “You Are What You Buy”, a special edition of TRENDS from the Retail Industry, specially designed for the Romanian market.

Here are the ten most important findings, and we invite you to download and use the entire report in your strategies.

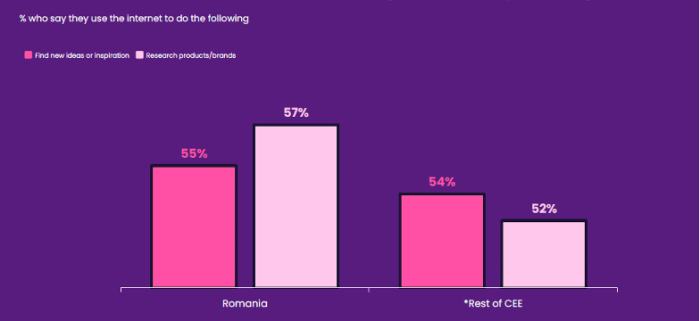

1. Inspiration-Driven Purchase Journeys: Romanian consumers increasingly use digital platforms for shopping inspiration. The visual and informational presentation of products and brands significantly influences their buying decisions, underscoring the importance of a solid online presence for retailers.

Consumers in Romania are 15% more likely than those in the rest of the CEE to use social for brand or product discovery.

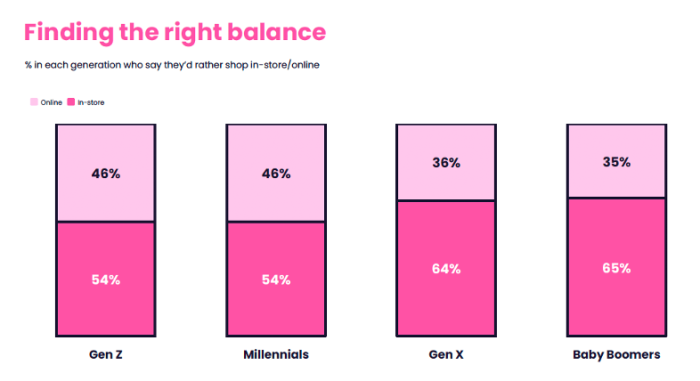

2. Preference for In-Store Shopping: Despite the global trend towards e-commerce, Romanian shoppers show a strong preference for physical stores. They value the tactile experience and immediate gratification of in-store shopping, which online platforms can’t fully replicate.

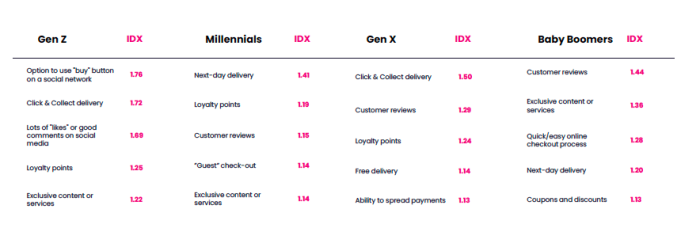

3. Loyalty Points as a Key Incentive: Loyalty programs, especially those offering reward points, are highly effective in Romania. They play a crucial role in fostering customer loyalty and encouraging repeat purchases, making them a vital strategy for retailers.

4. Impulse Buys in Personal Items: There is a notable tendency among Romanian consumers to make impulse purchases, particularly in the personal items category. Factors like in-store displays, promotions, and the immediate availability of products drive this behaviour.

5. Effective Brand Building: A solid brand presence on digital discovery platforms is essential. It helps brands stay on the top of consumers’ minds, influencing their purchase decisions, especially in the initial stages of the shopping journey.

6. Generation-Specific Purchase Drivers: Different generations in Romania have unique preferences influencing their purchasing decisions. Factors like loyalty points, customer reviews, and delivery options vary in importance across generations like Gen Z, Millennials, Gen X, and Baby Boomers.

7. Online Discovery Platforms: Online discovery platforms, including social media and review sites, play a significant role in the consumer purchase journey in Romania. They are critical in product discovery, research, and eventual purchase decisions.

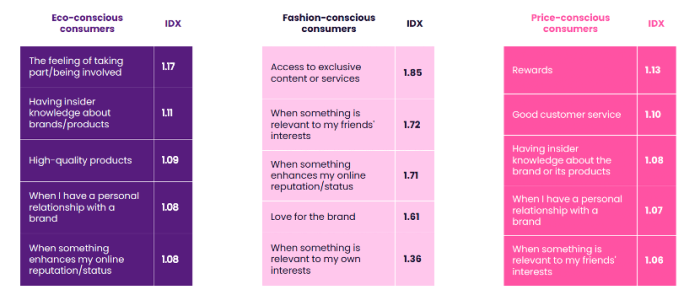

8. Eco-conscious Consumers: A growing segment of Romanian consumers prioritize environmental impact in purchasing. This trend influences how brands market their products and the types of products gaining popularity.

9. Fashion-conscious and Price-conscious Consumers: The report sheds light on the behaviour of consumers who are either fashion-conscious or price-sensitive. Their motivations and purchase behaviours provide valuable insights for retailers targeting these segments.

10. Impulse Buy Statistics: The report includes detailed statistics on impulse buying in Romania, contrasting planned versus actual purchases across various product categories. This highlights the importance of in-store marketing and product placement strategies.

All figures in this report are drawn from our partner GWI’s online research among internet users aged 16 – 64. Our figures are representative of the online populations of each market, not its total population. This report uses data from our ongoing quarterly global research across the following five markets: Bulgaria, Czech Republic, Hungary, Poland, and Romania. In Q2 2023, we surveyed 110,488 internet users aged 16 -64 across the CEE region and 1,258 internet users aged 16- 64 in Romania. In this report, we sometimes refer to indexes. Indexes compare any group against the average (1.00) unless otherwise stated, referring to the average consumer in the CEE region. For example, an index of “1.20” means a group is 20% above average.

All Publicis Groupe Romania proprietary data tools in one place.

All Publicis Groupe Romania proprietary data tools in one place.Discover the power of our tools and feel free to get in touch.