Since the beginning of the pandemic, we have all noticed a growing interest of Romanians in financial education. If, until now, the idea that the world could stop in an instant seemed like a movie-like idea, starting in 2020, it has become a possibility. Those caught without financial reserves were frightened by the impact that the COVID-19 period may have (54% of Romanians prioritized daily spending, hunted for discount products and postponed medium to large purchases, such as be it vacations, devices, appliances (according to a GWI study – “Coronavirus Research” in July 2020.) For others, it was a confirmation of the decision to save. At the same time, the number of card transactions has increased significantly. Here are the reasons:· The number of online orders has increased, which has led to an increase in card payments;· Offline attention to personal hygiene has led to the least possible use of cash payments. But there is another relatively recent reason, from 2021, for which Romanians have changed a habit: a certain brand has made constant and sustained efforts to generate an increase in the number of transactions.

Since the beginning of the pandemic, we have all noticed a growing interest of Romanians in financial education. If, until now, the idea that the world could stop in an instant seemed like a movie-like idea, starting in 2020, it has become a possibility. Those caught without financial reserves were frightened by the impact that the COVID-19 period may have (54% of Romanians prioritized daily spending, hunted for discount products and postponed medium to large purchases, such as be it vacations, devices, appliances (according to a GWI study – “Coronavirus Research” in July 2020.) For others, it was a confirmation of the decision to save. At the same time, the number of card transactions has increased significantly. Here are the reasons:· The number of online orders has increased, which has led to an increase in card payments;· Offline attention to personal hygiene has led to the least possible use of cash payments. But there is another relatively recent reason, from 2021, for which Romanians have changed a habit: a certain brand has made constant and sustained efforts to generate an increase in the number of transactions.

Ioana Vieru, Brand & Product Marketing Manager – VISA

“It is a real pleasure to monitor the financial field with the help of the Digital Health Index and its subscriptions. With this tool, we find out in real time what consumers react best to, we find out their barriers and sensitive points, and we act exactly. And Ioana, transactional relationships have the power to provide temporary peaks to any brand of finance, but the education component creates familiarity and closeness and brings long-term effects. “

Alexandra Caciur, Head of Data & Business Intelligence – DIGITAS ROMANIA

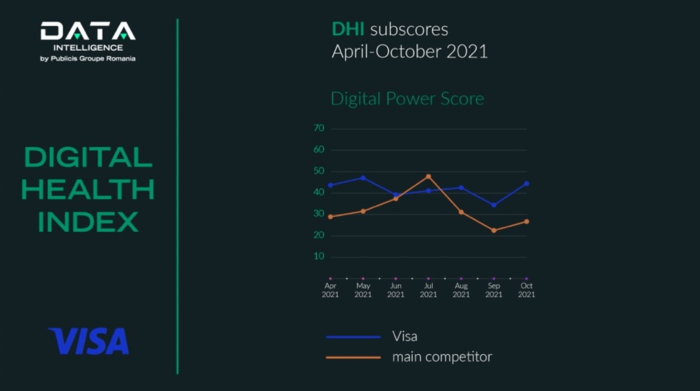

Let’s look, for example, at the earned media area: Digital Power Score (DHI sub-score) shows the interest generated by a brand in online searches. VISA manages to keep this indicator up precisely because of the always ON education component and the innovation that goes beyond the classic storytelling (e.g. TV spots), innovations that directly impact the daily life of Romanians (e.g. contactless payment in buses and trams ).

Featured products

All Publicis Groupe Romania proprietary data tools in one place.

All Publicis Groupe Romania proprietary data tools in one place.Discover the power of our tools and feel free to get in touch.