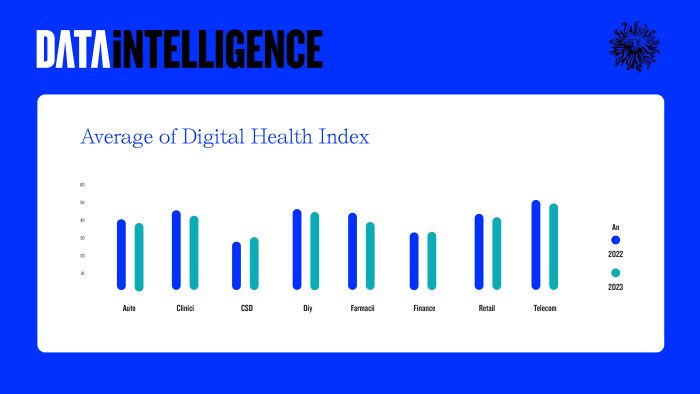

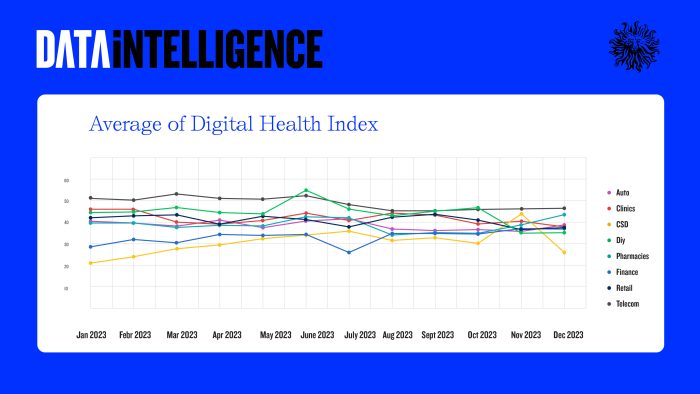

In the year 2023, following the pandemic years, most categories – Auto, Clinics, CSD (Carbonated Soft Drinks), DIY, Pharma, Finance, Retail, Telecom – experienced a decline in DHI, compared to the previous year. The main reason largely lies in budget reductions, even if this is not the main driver for health usually. The only exceptions are: the CSD category, which opposed the trend and saw growth, and the Finance category, which remained approximately at the same level as 2022.

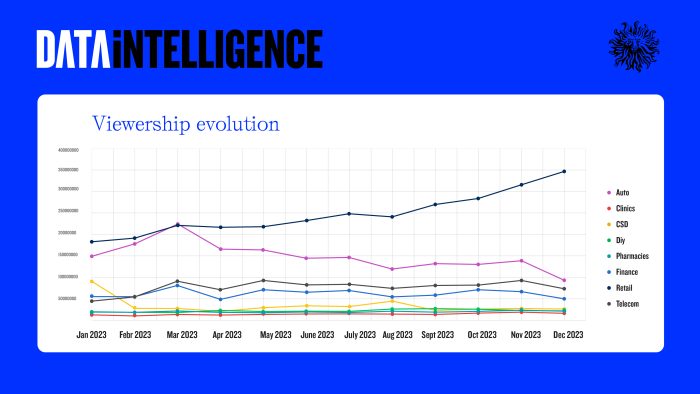

Visible increases were observed only towards the end of the year, following the Black Friday period and the holidays, from offers, contextual advertising, contests, giveaways, and, of course, partnerships with influencers.

The category with the most mentions was Auto, the category with the highest visibility was Retail (4 times greater than Auto), and the category with the most reactions was Finance.

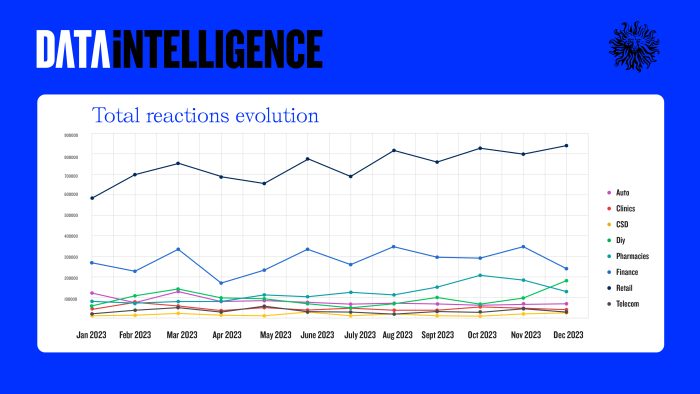

Regarding reactions, 60% of them come from Facebook, and 90% come from Meta (Facebook and Instagram).

Auto ranks second in terms of the highest visibility, with a significant contribution coming from the TikTok platform. Each month, the most visible mentions are generated by the videos posted on TikTok.

Although the Auto industry dominates with the most appearances in .ro, the Retail category attracts the widest visibility. However, in both cases, the most visible appearances come from the TikTok platform, but their nature differs significantly. In the case of the Auto industry, these are largely generated by user-generated content – from car enthusiasts to service centers or car showrooms. In contrast, the visibility of the Retail category is ensured by the massive presence of brands on this platform, which join various trends and challenges.

Retail category holds the most reactions on Social Media (Facebook, Instagram, YouTube), approximately 3.5 times more than the next category, Finance.

For all categories except CSD, over 60% of reactions come from Facebook, and similarly over 90% of reactions come from Facebook and Instagram, thus reinforcing the essential role these two platforms play in communication and audience engagement.

Conclusions for each category

Auto

- The category with the most appearances in .ro

- The category with the highest share of TikTok viewership (approximately 40%)

- On social networks, posts with the most reactions are those featuring newly launched models, especially hybrids, and contextual posts.

Clinics

- The category with the least visibility in .ro

- Among the most visible mentions are partnerships with podcasts, influencers, and events.

- On Facebook, posts with the most reactions are recommendations from professional doctors and information related to various conditions, as well as offers for tests and medical packages.

- On Instagram, posts with the most reactions are social initiatives, contests, giveaways, and partnerships with various events.

CSD

- The only category that recorded an increase (+13%) in DHI compared to 2022

- The category with the highest DHI growth (+43%) in November compared to the previous month: three times more reactions on Social Media, as a result of initiatives for the winter holidays.

- The category with the fewest reactions on Social Media, due to predominantly seasonal activity

- The category with the highest share of reactions from Instagram (approximately 45%)

DIY

- The category with the highest DHI value in June 2023, due to numerous sources of inspiration and product offers for terraces, gardens, and relaxation areas.

- The category with the most mentions recorded on forums (approximately 10%)

- Brand posts on social networks contribute to generating the highest visibility.

- On Facebook, posts with the most reactions are those offering suggestions and inspiration for DIY projects.

- On Instagram, posts with the most reactions are contests and giveaways.

Pharma

- The category with the fewest mentions in .ro

- The category with the highest proportion of positive sentiment appearances (approximately 40%)

- The category with the highest share of reactions from Facebook (95%)

- On social networks, posts with the most reactions include contests, contextual communication, and social initiatives.

Finance

- The category with the highest number of appearances in the press and aggregators (approximately 40%)

- The most visible mentions are represented by brand posts on social networks, podcasts, and partnerships with influencers.

- In social media, posts that generate the most reactions include contests, giveaways, and collaborations.

Telecom

- The category with the fewest active brands

- The category with the highest DHI score in 9 out of the 12 months analyzed

- On Social Media, posts with the most reactions are subscription and device offers, contests, and giveaways.

Retail

- The category with the highest visibility and the most reactions on social networks

- The mentions with the highest visibility come from TikTok and are posted by brands.

- On Facebook, posts with the most reactions are related to offers and recipes.

- On Instagram, the most reactions are recorded by posts involving partnerships with various events.

In a continuously changing digital era, a brand’s health is defined for its authentic and consistent presence online. In 2023, changes in communication strategies had a heightened focus on TikTok. Communities continued to be engaged through influencer marketing and partnerships with various events and, finally, through podcasts. From DIY tutorials and recipes for retail to health and sustainability information, various channels have been explored to reach the target audience.

The Digital Health Index remains an essential benchmark in evaluating the digital performance of different categories. In a dynamic and complex economic environment, quickly adapting to digital trends and finding ways to communicate effectively with the target audience, will determine the success and sustainability of companies. DHI is part of the Publicis Groupe Romania’s DATA Intelligence portfolio, available in interactive form at digitalhealthindex.ro.

All Publicis Groupe Romania proprietary data tools in one place.

All Publicis Groupe Romania proprietary data tools in one place.Discover the power of our tools and feel free to get in touch.