- Significant increase in activities such as information searching, connecting, and relaxing online, with a decrease in online gambling usage.

- Facebook is predominant (91%), followed by Instagram (59%) and TikTok on the rise (47%), approaching second place.

- The most memorable influencer campaigns on TikTok have been related to beauty and fashion, music, and lifestyle/entertainment.

- 54% of urban Internet users have at least one subscription to access video streaming platforms, with most using a Smart TV (76%).

Bucharest, December 18, 2023 – According to the Romanians New Media Adoption study, conducted by the Data Intelligence team of the media agency Spark Foundry, a member of Publicis Groupe Romania, there is an observed increase in the need for information, connection, and relaxation, while interest in online gambling is declining.

Facebook shows a steady trend while Instagram has a slight decrease, reaching the same level as in September 2021. TikTok is the only platform that continues its upward trend, getting closer to second place.

The most memorable influencer campaigns on TikTok were in the fields of beauty, music, and lifestyle/entertainment.

The study is part of Focus On: New Media Usage, a series of reports tracking the evolution of media consumption behaviors based on quantitative studies.

“Our recent study has shown that 68% of urban internet users prefer images and videos on social networks, with Facebook remaining the dominant platform, used by 91%. Also, TikTok has experienced remarkable growth, reaching 47% popularity. It’s fascinating to see how 87% of users own at least one Smart TV, and 34% of them exclusively watch online content. These data underscore the rapid change in digital behavior and the need for continuous adaptation of our marketing strategies,” stated Mădălina Bâdea – Head of Data Insights, Spark Foundry.

Digital Activity Evolution

A significant increase in activities such as information searching, connecting, and relaxing online, with a decrease in online gambling. Also, there’s a noticeable use of the internet for online payments (48%) and shopping (41%).

Main Reasons for Using Social Media

Social media is widely used for connecting and relaxing: 61% use social networks to stay connected with friends, and 57% for relaxation. There is also an engagement with brands on social media: 28% use networks to keep up with their favorite brands.

People aged 45+ primarily use social networks to stay connected with friends, to find out news about family, friends, or colleagues, or even to make new friends/acquaintances. Conversely, those over 55 use social networks to fill their free time/relax, to join different communities, to follow celebrities/influencers, and to support social causes.

Those aged between 35-55 years are more likely to want to keep up with the activities of their favorite brands, while the younger ones, aged 18-24, use social networks more for the diversity of content, to find out about new trends, and to post images and videos.

Social Media Platforms

The new study shows that the main social media platforms used by Romanians continue to be Facebook, Instagram, and TikTok: Facebook (91%), Instagram (59%), and TikTok (47%).

Facebook remains the most used platform, especially among those aged 25+. Those aged 18-34 are largely attracted to platforms such as Instagram and TikTok, while Tumblr is preferred by those aged 35-44. LinkedIn and Pinterest are mainly preferred by those over 55. Snapchat, Twitter, Tinder, Reddit, and BeReal are mostly favored by Generation Z (18-24 years old).

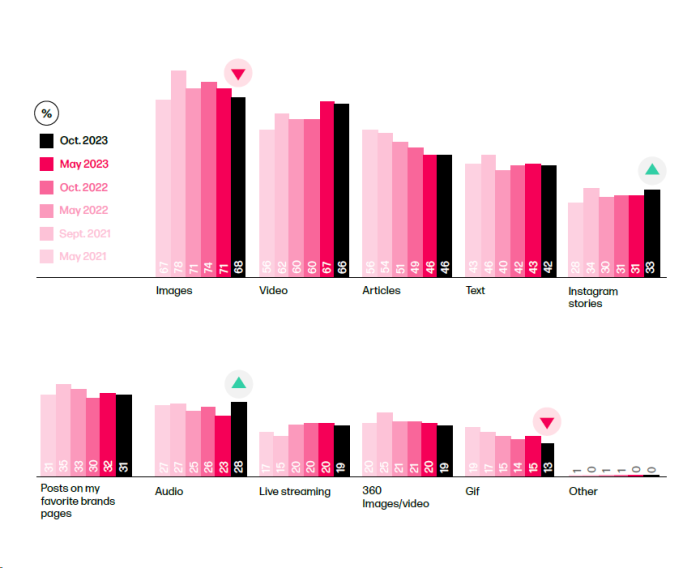

Preferred Content by Romanians on Social Media

Images and videos remain the preferred types of content on social media, followed by articles at a distance. While images and GIFs have shown a negative trend compared to the previous wave, Instagram stories and audio content have shown a positive trend.

Images and texts are popular, especially among those aged 45+, while videos, articles, and audio content are preferred by those over 55. Instagram stories are most appreciated by those aged 18-34, and posts on favorite brand pages are more sought after by those aged 25-34. Those aged 18-24 prefer GIFs, and both those aged 45-55 and the younger ones prefer 360-degree image/video content.

Instagram Activities

Instagram remains popular for following friends’ and acquaintances’ posts (69%), with no significant fluctuations from the previous wave. Significant increases have been recorded in activities such as viewing sponsored ads from favorite brands (26%), joining various online communities, and participating in live broadcasts of personalities/influencers they admire, while significant decreases have been recorded in activities such as broadcasting videos and scrolling through Stories.

Young people between 18 and 34 years old post stories on Instagram and react to polls/questions in Stories, while those aged 25-34 post photos and use filters. Following influencers is popular among those aged 18-24 and those over 55.

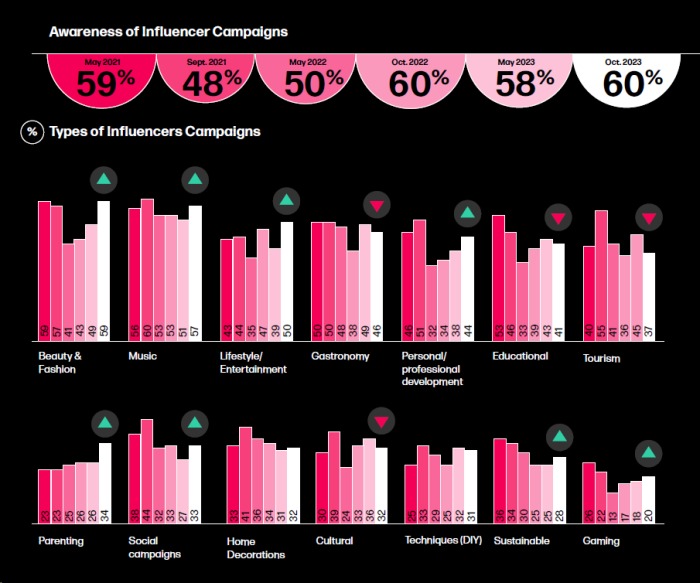

TikTok and Influencer Campaigns

There is a slight increase in the awareness of influencer campaigns compared to the previous wave, but it is at the level obtained in the same period of the previous year. The most notable influencer campaigns have been related to beauty and fashion, music, and lifestyle/entertainment, with the highest growth recorded in the lifestyle/entertainment and beauty & fashion domains.

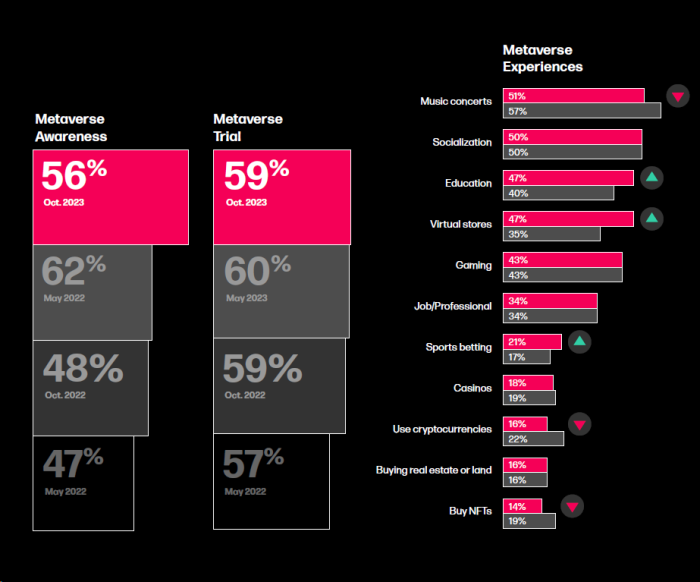

Metaverse

Awareness of the Metaverse concept has decreased compared to the previous wave, but remains above the levels from 2022. 56% of urban internet users have heard of the “Metaverse,” and 59% of them would be interested in exploring virtual experiences in the Metaverse. The interest is distributed as follows: 51% for musical concerts, 50% for socializing, 47% for education or virtual shopping, and 43% for gaming experiences in the Metaverse.

Audio Content Platforms and the Podcast Ecosystem

From the study, we can observe a stable notoriety of social media platforms with exclusively audio content compared to the previous wave. Users appreciate the novelty and authenticity in relationships and connections.

The frequency of watching/listening to podcasts is weekly for about 43% of respondents, a decrease from previous waves, while the number of those who follow/listen monthly or less often has increased. 16% of them follow/listen to podcasts daily, in a constant evolution compared to the previous wave. In particular, they prefer to watch interviews, comedy, content about lifestyle/health, and entertainment/celebrities.

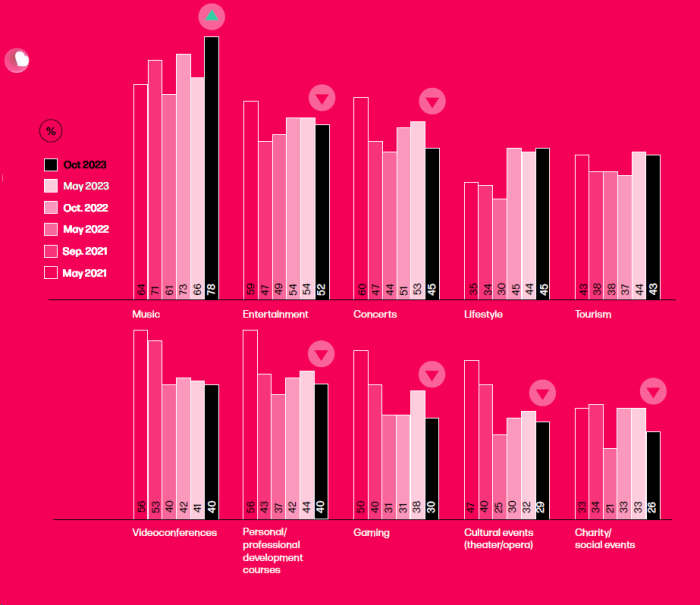

Evolution of Live Streaming Platforms and Content

Music remains the star of live streaming, with a notable increase compared to the previous wave, followed by entertainment. Concerts and gaming have seen significant declines. The preferred platforms are YouTube and Facebook, with a positive trend. A decrease is noted in those who watch live streaming on Zoom, Twitch, or directly on the organizer’s page.

E-commerce through social media

8 out of 10 urban users believe that the tagging function in social media is useful because it leads them directly to the store. More and more are shopping on pages like Facebook Marketplace and Facebook Shops.

Gaming

All gaming activities have had a positive or stable evolution, with the biggest advance being among those who play on social networks. Free video games remain the most popular, especially on smartphones. Young people between 18 and 24 years old prefer to play online with friends or to use subscription services such as XBOX LIVE or PlayStation Plus. In urban areas, half of the internet users already have a favorite game, and for 4 out of 10, friends’ recommendations are important. Recently, interest in in-game storytelling has decreased. Both the young and the older appreciate friends’ recommendations and the popularity of games. Young people pay particular attention to graphics, story, and recommendations from gaming influencers, while those between 25 and 34 years old appreciate the ability to personalize the game.

Online Communities

Urban internet users join online communities, primarily to establish connections and interact with people who share the same interests. There is a positive evolution among those who join a brand’s community to get updated information about it and among those who participate in contests or events posted within the community.

Local Targeting Function and Nearby Events

In this study, we note a decrease from the previous wave in the percentage of users who use app functions to search for events near them. In addition, we observe a significant increase among those who use the location function and find it useful.

After using location apps, many look for more information about events, registering a slight increase compared to the previous phase. Although decreasing compared to previous years, many consider participating in events after using these apps. In this wave, events posted on social networks by brands especially attract the attention of people aged 45+. Those most willing to participate are aged between 18 and 24, and those most receptive to nearby events are those aged between 35 and 44.

Romanians and Smart TVs

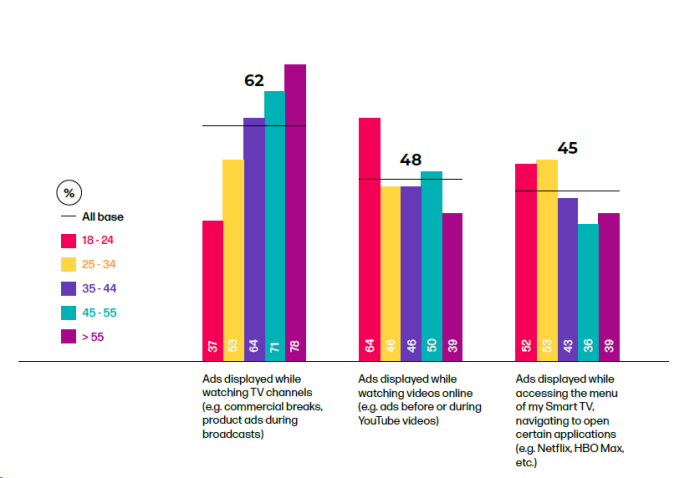

87% of urban internet users have at least one Smart TV in their household; 34% of them watch exclusively online content, while about 15% prefer the classic TV. The majority of urban internet users (62%) have watched ads while watching TV channels on Smart TV, 48% have watched ads while viewing online videos, and 45% have watched ads while navigating through the Smart TV menu to open applications. Those aged 45+ have noticed ads more when watching TV channels on Smart TV. Young people, aged between 18 and 24, especially noticed ads while watching online videos, and those aged between 25 and 34 have seen ads while accessing the Smart TV menu.

41% of urban internet users watch online content on Smart TVs exclusively via subscription (e.g., Netflix, HBO, Voyo), while 18% watch exclusively without a subscription (e.g., YouTube). Those who prefer subscriptions are mostly aged between 25 and 44 years old, while those who do not use a subscription are younger, aged between 18 and 24 years old.

Media Consumption with Family

Most people still watch TV programs with their family, considering that this activity brings them closer together. There is a positive trend for those who have made watching TV programs or online videos a habit. A decrease is recorded in the preferences of those who choose TV news over online news and in the time spent in front of the television in the last 12 months. Young parents, between 25 and 44 years old, watch less children’s content than during the pandemic. Regarding information, those aged between 35 and 55 years trust TV news more than online news, while those between 25 and 34 years old watch local news less than during the pandemic.

Video on Demand (VOD)

54% of urban internet users have at least one subscription to video streaming platforms, with the majority accessing them via Smart TVs (76%). Netflix is the most popular, closely followed by HBO Max and Disney+. The only platforms that saw a decline from the previous phase are Netflix, SkyShowTime, and Voyo.

Methodology

The study was conducted by the Data Intelligence team of the media agency Spark Foundry, using the CAWI (Computer Assisted Web Interviews) method, on a sample of 810 people, female and male, over the age of 18, internet users, from urban areas, during the period of October 4-11, 2023. The full presentation of the study can be requested at the email address: contact@dataintelligence.ro

All Publicis Groupe Romania proprietary data tools in one place.

All Publicis Groupe Romania proprietary data tools in one place.Discover the power of our tools and feel free to get in touch.